According to the U.S. Small Business Association, small businesses employ 59.9 million people in the U.S. Businesses have many reporting and withholding responsibilities to the Internal Revenue Service, their state tax department and, in some instances, local government authorities.

Businesses also have duties to provide their employees with detailed information concerning payment for work performed, taxes withheld, and more. Employers also need to file a Wage and Tax Statement (W-2) for each of their employees. This form will assist the employer in calculating tax withholdings from their employee’s wages.

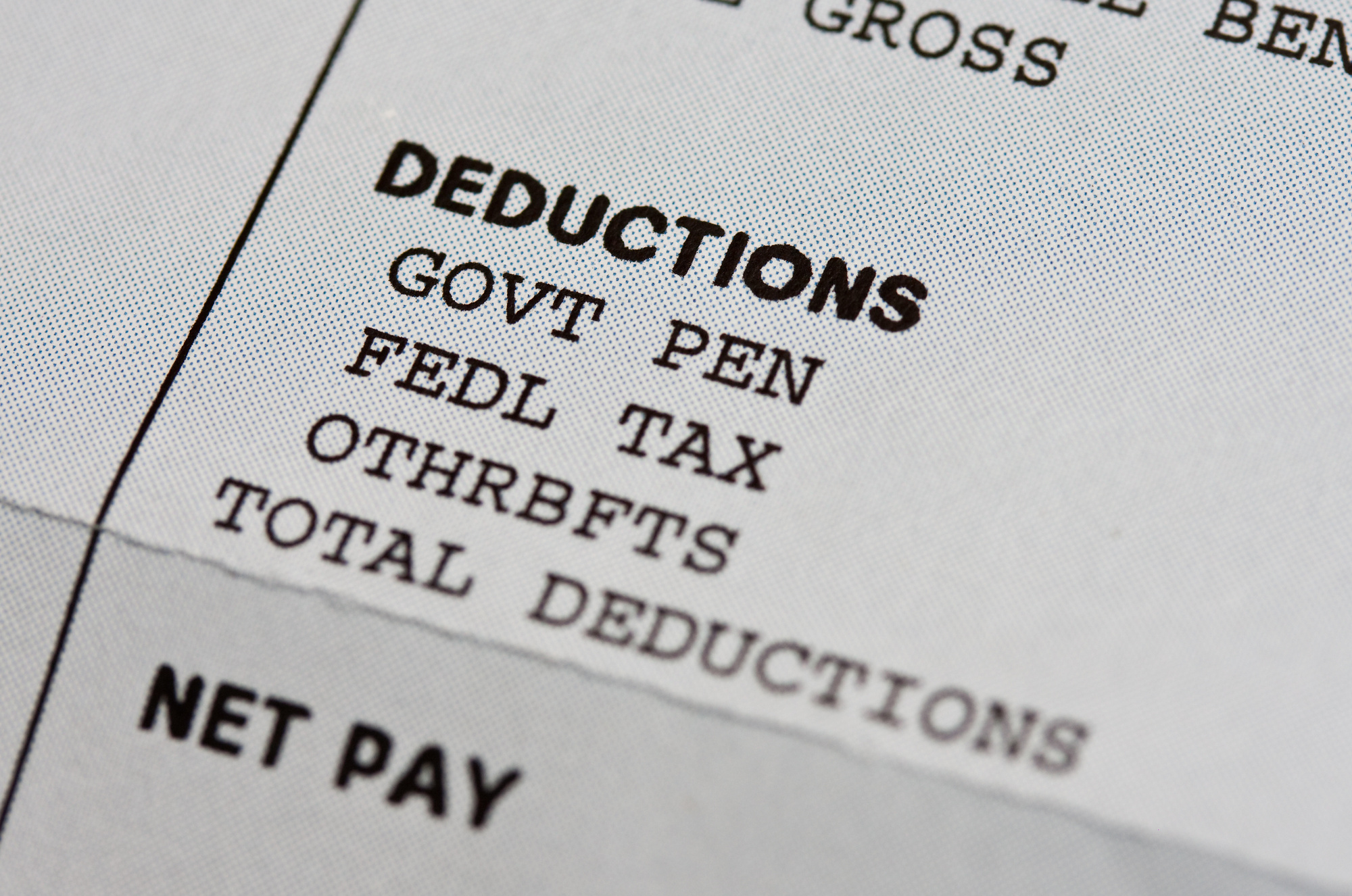

When an employer pays their employee, they need to provide their employee with a check stub aka pay stub. If you’re new to having employees or new to handling payroll, you may be wondering “What is a check stub and what does it need to show?”

Let’s answer those questions.

What is a Check Stub?

A check stub should accompany each payment to an employee to show how the employer calculated the amount they are being paid. Check stubs provide the employee with an opportunity to check the employer’s calculations and bring any errors to their employer’s attention.

What Do Check Stubs Need to Show?

Check stubs should to identify the individual employee being paid and include sufficient information to fully inform an employee regarding each payment of wages or salary. Not all check stubs will include the following information, but this is a list of items that commonly listed.

Employee Identifying Information

A check stub should include the employee’s full name. It can also include the employee’s address and social security number.

Date Paid

Check stubs should show the date the employee was paid. This is the date the check is written or the date of the direct deposit.

Pay Period

The pay period should be listed on the check stub. Businesses pay their employees on different schedules. Such as, be daily, weekly, every other week, twice a month, or monthly.

Gross Pay

Gross pay is the total amount an employee earned during a pay period.

For hourly employees, list their hourly rate and the number of hours worked. If they worked overtime, list the hours worked and the overtime pay.

For salaried employees, list the portion of their salary they have earned. This can be calculated by dividing their yearly salary by the number of payments they receive per year. For example, if they get paid monthly, divide their yearly salary by twelve.

If you’re paying your employee a bonus, specify it as a bonus and list it in the gross pay section of the pay stub along with the amount.

List of Deductions and Contributions

Employers must deduct federal, state and (sometimes) local taxes from their employee’s wages. Also, list the amounts your business pays for federal and state unemployment tax and FICA taxes.

The folks at PayStubs.net also encourage you to list all the other deductions and contributions made. For example, for the health insurance premiums and retirement accounts, and whether they were made by the employer or the employer.

Net Pay

Net pay is the amount the employee receives from their gross pay after calculating all the deductions.

Providing Check Stubs Makes Good Business Sense

Understanding the answer to the question “What is a check stub?” and providing the necessary information to your employees will help you communicate better with them about their earnings. It also makes your job easier because employees can review their check stub rather than having to ask for details in person.

If you’re looking for other great business articles, you can find more of them on our website.

Speak Your Mind