Seventy-nine percent of borrowers today are interested in loans that will be due in installments. Getting a loan with a bad credit score is a sophisticated experience. Most lenders will look at your financial credibility before they commit to giving you any loan.

Having a bad score is not a death sentence. If you’re getting punished due to your credit report, we are here to help you.

With the right tips, it is easy to get installment loans regardless of your credit report. This type of loan helps one make payment even when their credit score does not allow.

What Are Installment Loans?

This is a type of loan where you borrow a lump sum amount from a lender. The borrower has the flexibility to choose the desired amount and receives it all at once. Unlike other loans, installment loans should be paid within a fixed period that will be agreed with the lender.

The amount you get is then divided into installments and should be paid within that time. Most payments have monthly schedules, although this is subject to change depending on your agreement. Each payment you make is called an installment.

The best thing about installment loans is that the lender does not focus on your credit score but rather your ability to repay.

How It Works

Almost all loans work in the same way. The process starts when you submit your application and indicate your interest in the loan. The only difference between installment loans and other loans is that it gets approved within a few minutes.

If you apply in person, it’s possible to get the loan within the same day. This means you can apply and receive money to spend on the same day.

When you apply online, the approval period takes a slightly more extended period. The lender may delay your loan transfer period for at least one business day.

Once you get the money, the payment is spread over several months, and you will not have to pay a lump sum with your credit card.

When you fail to repay your installments as per your agreement with the lender, you will incur additional penalties. Regardless of your credit card status, it is essential to ensure that you can repay the loan and interest within the stipulated period. This may help you correct your credibility for future financial goals.

Common Installment Loans

Most loans are classified in the installment loan category. If you wish to know if your current loan is serviced under this category, the tips on this page will help you make the right decision.

Here are some examples of installment loans you should consider.

- A Student Loan

The government offers most of its assistance to students in the form of loans. The money given to students in the form of student aid may not be paid back with interest, and even if it is, the interest rate will not be that high. The best part is most loans are offered without considering your credit score.

- Loans from an Online Platform

You can get a quick payday loan online. These platforms allow you to borrow money directly from a lender instead of getting it from an institution. Even if you do get the no credit check payday loans from an institution, both you and the lender stand to benefit.

On many occasions, your bad credit will not matter because you will be repaying the money with interest.

- Credit Unions

Credit unions are made up of members who have something in common. These unions pass on earnings to their members in the form of excellent customer service and lower fees.

If you have a credit union near you, you can go and discuss a personal loan with them. Comparing loans from different institutions guarantees that you will get the best offers.

- Home Equity Line Of Credit

Owning your own home comes with more advantages than just not paying rent; you can be able to get loans from your property. With equity in your property, one can get low interest and tax- deductible line credit that you can use for any commercial venture.

Get a Co-Signer

If your friends and family do not have the money to lend to you, they can agree to co-sign with you. Remember that if you do not pay back the loan, it may affect your co- signer’s credit score and they will have to pay the loan.

Family and Friends

This is one way of getting a loan that will help you pay off your credit card debt or other things you want to pay off. The best thing about getting money from family and friends is that you will not be required to pay back the money with any amount of interest.

Friends are also lenient enough to let you have the money for as long as you need. So, you will not feel pressured to pay it back.

Auto Loan

Auto loans are typically paid within a range of 12 to 96 months. Most lenders don’t offer such long loans, especially to people with a bad credit report. For these reasons, some lenders offer the loan with a shorter repayment period.

You may also get a lender who is willing to overlook your credit score but may need to use your car as collateral. This type of loan also falls under an installment loan.

Don’t Give Up

Bad credit score should not limit you from making any financial plans. Instead, try and reach out to potential lenders and try your luck.

Most of these installment loans are available online, and you will not have to feel the embarrassment of trying. Additionally, getting turned down today doesn’t mean you will not get approved tomorrow.

If you’re looking for a loan but are worried about your score, check out our service page. We can work out a plan that will ensure you get appropriate assistance without overstretching your credit score.

A social security card may be damaged, lost or stolen. Also, when some people get married or divorced, they opt to change their social security information. When you find yourself in such situations the first question that comes in your mind is,

A social security card may be damaged, lost or stolen. Also, when some people get married or divorced, they opt to change their social security information. When you find yourself in such situations the first question that comes in your mind is,  Many people are scared of getting to their age of retirement despite the fact that they don’t have to work anymore. This is because they start to worry about getting older, finding things to do when not at work and managing their finances on a pension. The good news is that retirement doesn’t have to be scary if you make sure that you prepare your finances carefully. To help you with this, we have put together some advice in this article. Keep reading to find out more.

Many people are scared of getting to their age of retirement despite the fact that they don’t have to work anymore. This is because they start to worry about getting older, finding things to do when not at work and managing their finances on a pension. The good news is that retirement doesn’t have to be scary if you make sure that you prepare your finances carefully. To help you with this, we have put together some advice in this article. Keep reading to find out more.

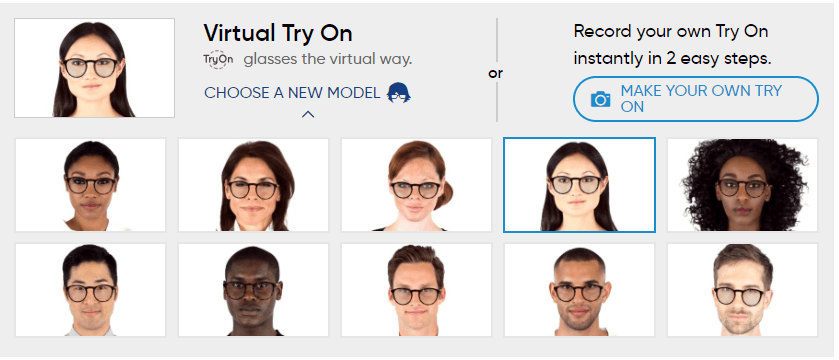

My girls had fun picking out the frames they wanted. DiscountGlasses.com offers 2 different ways to virtually try on their frames. You can choose from one of 10 virtual models to see what the glasses would look like on them or you can upload your own photo and virtually try the glasses on your own image. How cool is that?!?!

My girls had fun picking out the frames they wanted. DiscountGlasses.com offers 2 different ways to virtually try on their frames. You can choose from one of 10 virtual models to see what the glasses would look like on them or you can upload your own photo and virtually try the glasses on your own image. How cool is that?!?! I’ll admit I was a bit skeptical about virtually trying on glasses but the whole process was really easy. You sit in front of your computer, click the button, follow the simple directions, and in moments the website creates a virtual model of you. My girls had so much fun using themselves as virtual models that I decided to give it a try myself. It’s amazing how you can drag the image of yourself to the right and left and see what the glasses would look like on you from all angles. Pretty awesome if you ask me. I don’t need new glasses for a few more months but I really like how this pair looked on me.

I’ll admit I was a bit skeptical about virtually trying on glasses but the whole process was really easy. You sit in front of your computer, click the button, follow the simple directions, and in moments the website creates a virtual model of you. My girls had so much fun using themselves as virtual models that I decided to give it a try myself. It’s amazing how you can drag the image of yourself to the right and left and see what the glasses would look like on you from all angles. Pretty awesome if you ask me. I don’t need new glasses for a few more months but I really like how this pair looked on me. Ordering from DiscountGlasses.com was really easy, too. When you place the order you can enter the prescription information from your eye doctor or you can give DiscountGlasses.com your doctor’s contact information and they will contact your doctor on your behalf to get your prescription. The only thing we had to do ourselves was measure our girls’ pupil distances (also called PD). There is a ruler you can print right from the website and measuring was easy. It took about a week for the glasses to arrive from the date they were shipped and less than 2 weeks overall from the date we placed the order. Part of that wait time was DiscountGlasses.com waiting for the doctor to get back to them with the prescription so if you have your prescription handy I suggest you enter it in yourself.

Ordering from DiscountGlasses.com was really easy, too. When you place the order you can enter the prescription information from your eye doctor or you can give DiscountGlasses.com your doctor’s contact information and they will contact your doctor on your behalf to get your prescription. The only thing we had to do ourselves was measure our girls’ pupil distances (also called PD). There is a ruler you can print right from the website and measuring was easy. It took about a week for the glasses to arrive from the date they were shipped and less than 2 weeks overall from the date we placed the order. Part of that wait time was DiscountGlasses.com waiting for the doctor to get back to them with the prescription so if you have your prescription handy I suggest you enter it in yourself.

My girls love that DiscountGlasses.com offers Transition Lenses for an additional price so they can go from indoors to outdoors without needing an additional pair of sunglasses. As a parent this feature is worth every penny (only $69 more). If my girls had separate sunglasses it would just be one more item for them to keep track of, and let’s be honest, one more item for them to lose. So Transition Lenses really work for us.

My girls love that DiscountGlasses.com offers Transition Lenses for an additional price so they can go from indoors to outdoors without needing an additional pair of sunglasses. As a parent this feature is worth every penny (only $69 more). If my girls had separate sunglasses it would just be one more item for them to keep track of, and let’s be honest, one more item for them to lose. So Transition Lenses really work for us. Here is a little more information on DiscountGlasses.com:

Here is a little more information on DiscountGlasses.com:

Credit

Credit Credit

Credit Credit

Credit Photo Credit

Photo Credit